1. What’s New at Princeton?

In a significant step toward accessibility and affordability, Princeton University is expanding its financial aid program for the 2025–2026 academic year. Beginning this fall, most undergraduate students from families earning up to $150,000 annually will have their full cost of attendance covered, including tuition, room and board, books, and personal expenses. Families with incomes up to $250,000 will also qualify for tuition-free enrollment. This initiative is designed to remove financial barriers and ensure that a Princeton education is accessible to students from a diverse range of economic backgrounds.

Princeton’s expansion is part of a significant movement among Ivy League schools to make education more accessible to all. Earlier this year, Harvard University announced that it would offer free tuition to students from families earning up to $200,000 per year, with full coverage of all costs for those earning up to $100,000. Similarly, the University of Pennsylvania and the Massachusetts Institute of Technology have expanded tuition-free policies for families within specific income brackets. Initiatives like these are helping to break down financial barriers, giving more talented students the chance to pursue top-tier education without the heavy burden of debt.

Aralia Empowers Students From Around The World

Approximately 25% of Princeton’s Class of 2029 are students from lower-income families who qualify for federal Pell Grants, the highest number in the University’s history. Pell Grants are need-based federal scholarships that do not have to be repaid, designed to help students from low-income households afford college.

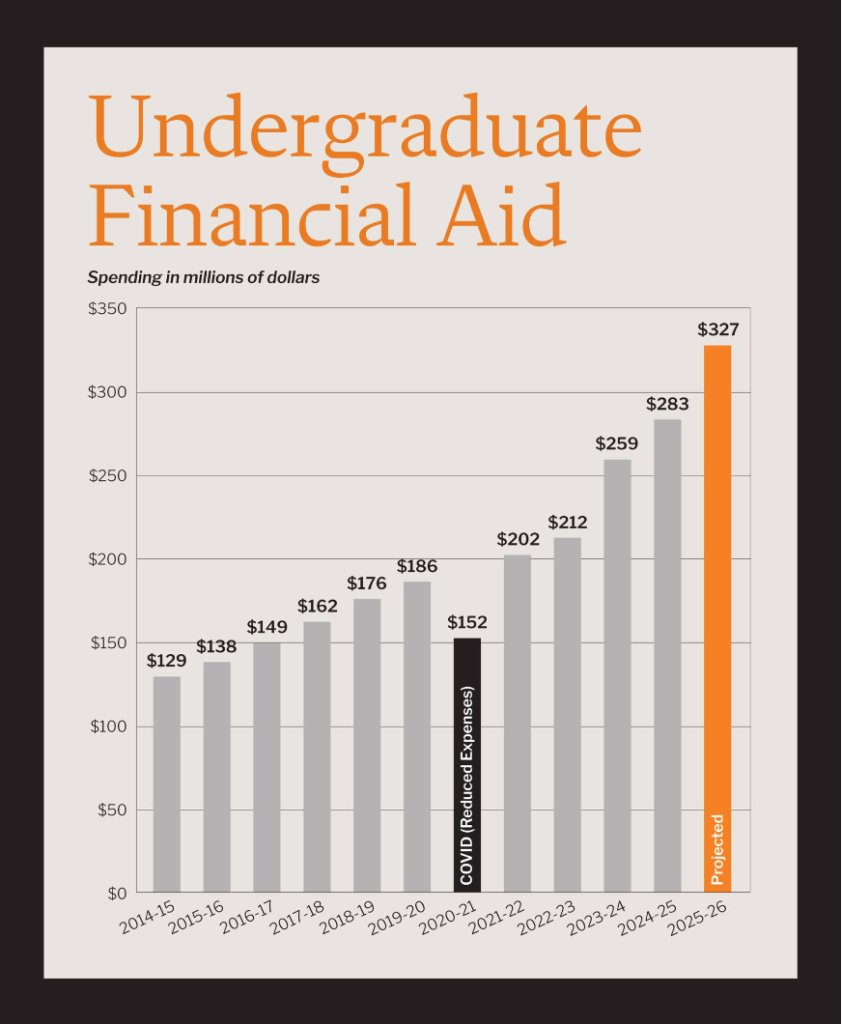

Overall, Princeton will spend approximately $327 million on undergraduate financial aid next year, up from roughly $283 million in the previous year, a 15.5% increase.

The university estimates that the average aid package for the upcoming school year will exceed $80,000, with approximately 69 percent of the class qualifying for some form of financial aid. These latest increases build on the substantial financial aid enhancements implemented in fall 2023.

2. Why This Matters

Free tuition and fully funded financial aid were once rare in U.S. colleges, often limited to small schools or highly competitive scholarships. Over the past two decades, however, some of the nation’s top universities have expanded access to higher education through tuition-free initiatives. MIT, the University of Pennsylvania, and Harvard have all announced programs to cover tuition and other expenses for families within specific income brackets, making elite education more attainable for students from diverse backgrounds.

Princeton University has long been a pioneer in this area. In 2001, it became the first university in the country to eliminate loans from its financial aid packages, replacing them with grants. This approach allows students to graduate without debt and has set a standard for other institutions. Over the years, Princeton has consistently increased its financial aid budget to support students from a wide range of socioeconomic backgrounds.

Now, for the 2025–2026 academic year, Princeton is continuing its commitment to affordability by expanding its financial aid program even further. This latest expansion ensures that more students than ever can access a Princeton education, regardless of their economic circumstances.

Provost Jennifer Rexford emphasized: “Through our increased investment in financial aid, we are making the transformative experience of a Princeton education more affordable for more students than ever.”

In short, this initiative aligns with broader national discussions about the rising costs of higher education and the need for systemic reforms. As more institutions adopt similar policies, the collective impact could lead to a significant shift in the accessibility and affordability of higher education across the United States.

3. How Princeton’s Financial Aid Program Works

The university is drawing on its endowment, valued at about $34.1 billion, which has averaged a 9.2 percent annual return over the past decade.

For the 2025–2026 academic year, Princeton’s new policy essentially divides financial aid into three tiers:

Family Income | What’s Covered |

Up to $150,000 | Full cost of attendance: This means that tuition, housing, meal plans, textbooks, and even personal expenses are all covered by Princeton. Families in this range would have virtually no out-of-pocket costs. |

Up to $250,000 | Tuition only: Princeton will waive the tuition bill entirely; however, families will still need to cover other expenses, such as housing, food, and books. This still amounts to a savings of about $66,000 a year. |

Up to ~$350,000+ | Partial aid possible: While wealthier families typically don’t qualify for much financial assistance, those with more than one child in college at the same time may receive some grant funding to help ease the financial load. |

4. If You Are Planning to Apply for Princeton Financial Aid

Step 1: Gather Financial Documents

- Collect family income information, including tax returns, W-2s, pay stubs, and bank statements.

- International students should prepare translated documents showing their family’s income and assets.

Step 2: Complete the CSS Profile

- All students (U.S. and international) submit the College Scholarship Service (CSS) Profile.

- This online form collects detailed financial information to determine eligibility for institutional aid.

Step 3: Submit the FAFSA (for U.S. students only)

- U.S. citizens and eligible non-citizens must submit the Free Application for Federal Student Aid (FAFSA) to qualify for federal grants, including the Pell Grant.

Step 4: Review Princeton’s Financial Aid Forms

- Princeton may request additional documents to clarify financial circumstances, such as household expenses or other information.

Step 5: Wait for the Award Notification

- Princeton’s financial aid office reviews all submissions individually

- Students receive a detailed financial aid award package showing grants, scholarships, and any optional student employment or loans (if applicable).

Step 6: Accept Your Aid Package

- Review the offer carefully and accept the grants and awards you qualify for.

- If circumstances change, contact Princeton’s financial aid office.

Aralia Students Are 4x More Likely to Publish a Research Paper

5. Does the Princeton Free Tuition Policy Apply to International Students?

Princeton is one of the few institutions that offers need-blind admission to all applicants, including international students. This means that, unless future government legislation changes, an applicant’s financial situation does not affect their admission decision. To see the requirements and learn how to apply as an international student, visit Princeton’s financial aid and admissions page.

On July 4, 2025, the president signed the One Big Beautiful Bill Act into law, making changes to some federal student aid programs. Stay informed about important updates from the new law and any actions you may need to take.

6. The Bigger Picture

By covering more costs for more families, Princeton is making itself accessible to a wider range of talented students, including those who might have thought an Ivy League education was out of reach. From an institutional standpoint, reducing the number of students who pay full tuition could also have strategic advantages. For example, there’s currently a proposed federal tax that would require wealthy universities to pay 8% on certain investment returns from their large endowments. By investing more of its endowment earnings into financial aid, Princeton could potentially reduce the portion of its assets subject to that tax.

In other words, this move could help Princeton both fulfill its mission of attracting top students regardless of financial background and maintain its long-term economic health. Over time, policies like this could prompt other elite schools to expand their own aid programs, resulting in broader changes to the landscape of higher education.

If you’re interested in exploring more opportunities like those offered by Princeton, many other U.S. universities provide full financial support to international students. To learn more, check out Aralia’s guide on 10 U.S. Universities Offering 100% Financial Aid to International Students.